24

Texas Association of Builders

May/June 2016

Feature

market. Increased economic prosperity has

stimulated the need for land, especially

anything within close proximity to the

major metropolitan areas. That drove up

the cost of developable land, and it also

drove up the price expectations of people

who own acreage.

“Local communities want control over their

land development, and permitting fees are

rising,” said Gaines. “Texas has always been

a laissez faire state.” Regulatory cost of land

development and new home construction

had been quite low, particularly compared

to places like Florida and California, but

those costs are nowmuchmore pronounced

than they have been historically. This

only adds to the cost for home builders,

particularly those trying to construct

new homes at the lower end of the cost

spectrum. “With the economic prosperity

and wealth created, more and more people

were demanding $500,000 houses,” said

Gaines, “so home builders went into that

market where they get a better margin.

It’s an imbalance of supply and demand.

There’s a much higher level of demand right

now, and that’s bringing prices up.”

Texas is, of course, a sizable chunk of

land. These economic conditions are not

uniform across the state. There is a marked

difference between the housing markets

in two of the state’s largest metropolitan

areas. “Houston has definitely slowed down

because it’s much more tied to the energy

sector. Sales volume there is negative,” said

Gaines. “Dallas is way up and still booming.

The entire DFW Metroplex is much more

parallel with and reflective of the national

economy in terms of the diversity of jobs

and economic activity.” Also, within the

last year or so, over 10 major companies

have made the move to the Dallas area,

causing a mini, localized boom. And what

about Texas’ other major cities? According

to Gaines, Austin is down slightly after

being “off the charts” for the past few years,

and San Antonio is still solid.

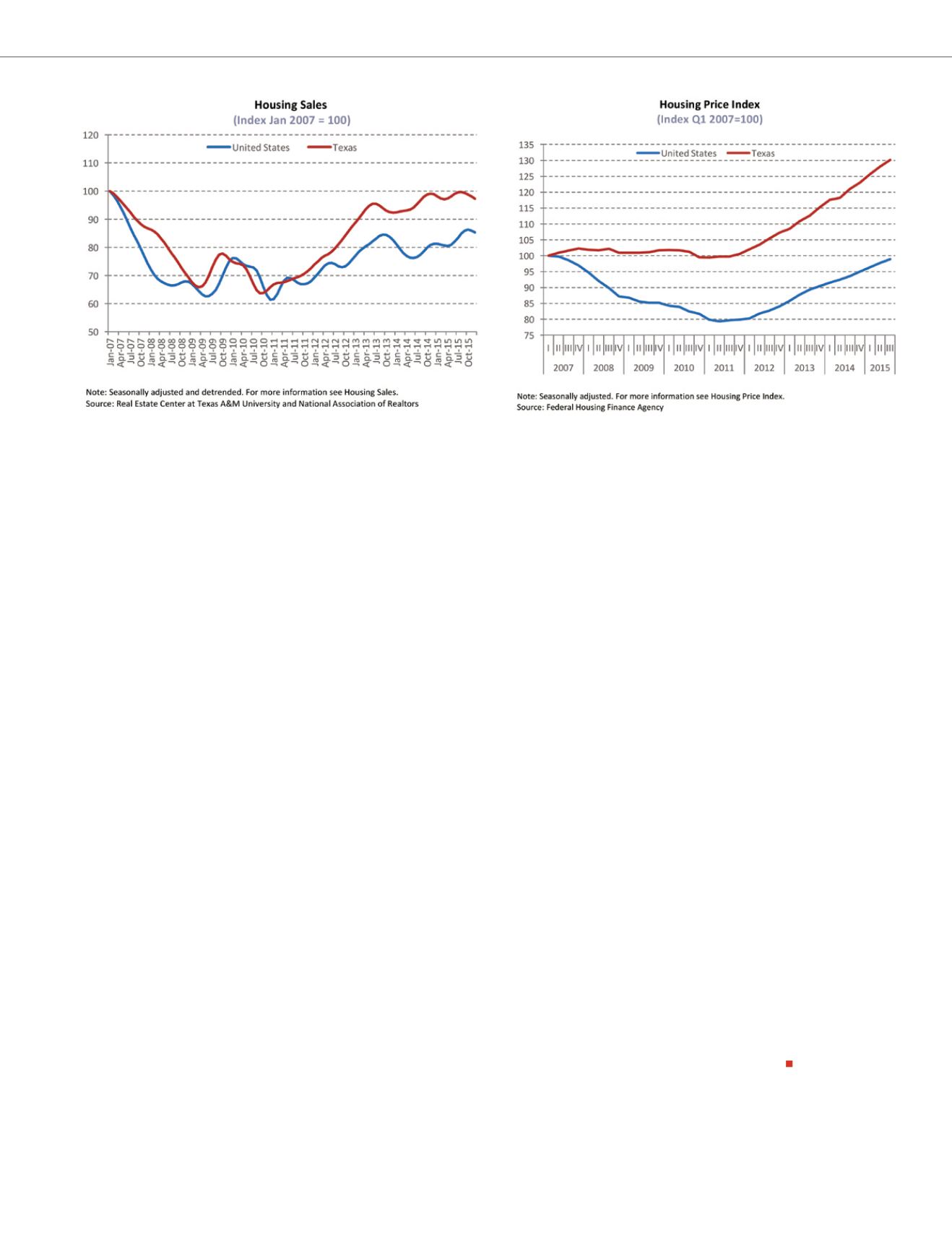

Crunching the Numbers

Dr. Gaines’ Real Estate Center colleagues,

Dr. Luis Torres and Wayne Day, put out

a monthly report called

Outlook for the

Texas Economy

that summarizes significant

state economic activity and trends. In their

March report—which utilized findings

from January—they found that statewide

housing sales increased 1.9 percent year-

over-year on a seasonally adjusted basis.

As Gaines said, Dallas-Fort Worth and San

Antonio sales have increased, but Houston

dropped 4.4 percent and Austin was down

1.4 percent. Overall, Texas’ housing sales

growth has fallen behind the nation’s

growth rate in recent months.

HERE ARE SOME MORE NUMBERS TO CONSIDER:

-

$31.46 average price per barrel

of West

Texas Intermediate crude oil compared with

$47.29 a year earlier

-

3.75 months of inventory

of Texas houses

for sale—that’s low: 6.5 months of inventory

is considered indicative of a balanced

housing market

-

3 percent growth of construction

employment

(year-over-year)

-

4 percent decline of manufacturing

employment

(year-over-year)

-

4.2 percent Texas unemployment rate

compared to 4.9 percent nationally

For a Texas builder, this article may not

be the most desirable or clear forecast

one could ask for. The state’s economy is a

complicated beast, and the housing market

follows suit. Depending on location, supply

and demand, the national economy, and

other factors, there is much to consider.

But one thing is becoming more and more

obvious—in Dr. Gaines’ own words, “The

bloom is off the boom.”

For more detailed information from

TAMU’s Real Estate Center, please visit

their website:

www.recenter.tamu.edu