13

Feature

Even though Texas has four major basins

where production has boomed, oil-related

activity is concentrated in the Permian

Basin in West Texas and the Eagle Ford

in South Texas

(Chart 2)

. These two areas

account for more than 80 percent of the

oil produced in Texas. The Barnett and

Haynesville regions, on the other hand,

produce primarily natural gas. Low oil

prices, therefore, will more significantly

impact drilling activity in West and South

Texas. They will also negatively affect

royalty payments to landowners more

significantly in those areas, affecting

local residents’ incomes and, potentially,

reducing spending in the area.

Break-even prices—estimates for what oil

prices must reach to provide a reasonable

return on investment—also vary across

basins, both within Texas and across the U.S.

Factors influencing break-even prices include

well productivity, drilling costs and the

presence of other hydrocarbons besides oil.

Studies tend to find higher breakeven prices

in the Permian Basin and relatively lower

ones in the Eagle Ford and the Bakken

Shale in North Dakota. They also find

significant variation in break-even prices

within a given basin. Although no hard

data exist for Texas, a recent study by North

Dakota’s Department of Mineral Resources

showed that break-even prices in different

counties in the Bakken ranged from $28 to

$85 a barrel, with an average of $56.

4

These findings suggest diminished

drilling in all major plays, since each

will have specific areas with high

break-even prices. The Permian is most

susceptible to a slowdown. Indeed, the

basin lost over 200 rigs from the first

week of December to the last week of

February, significantly more than in the

Eagle Ford or the Bakken.

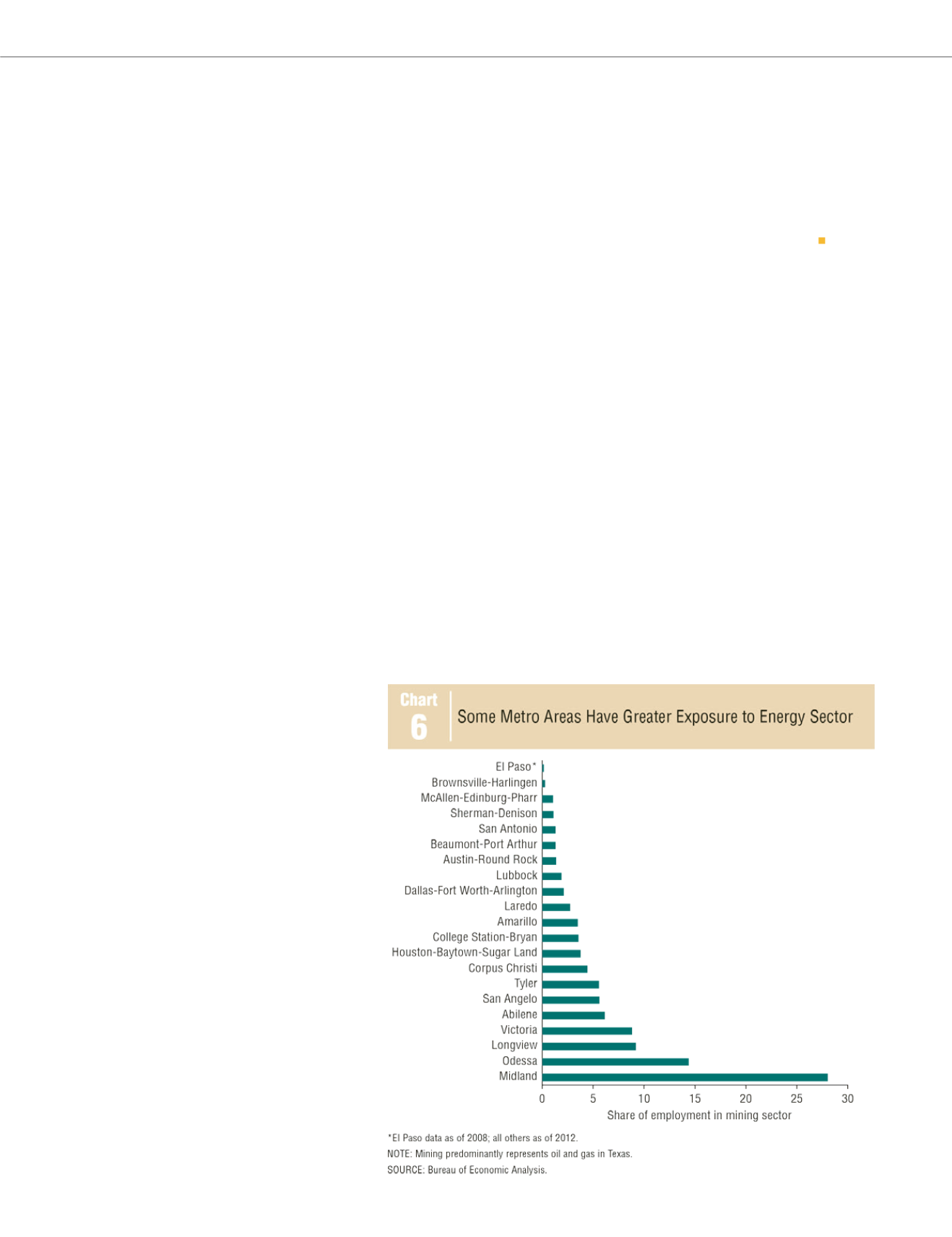

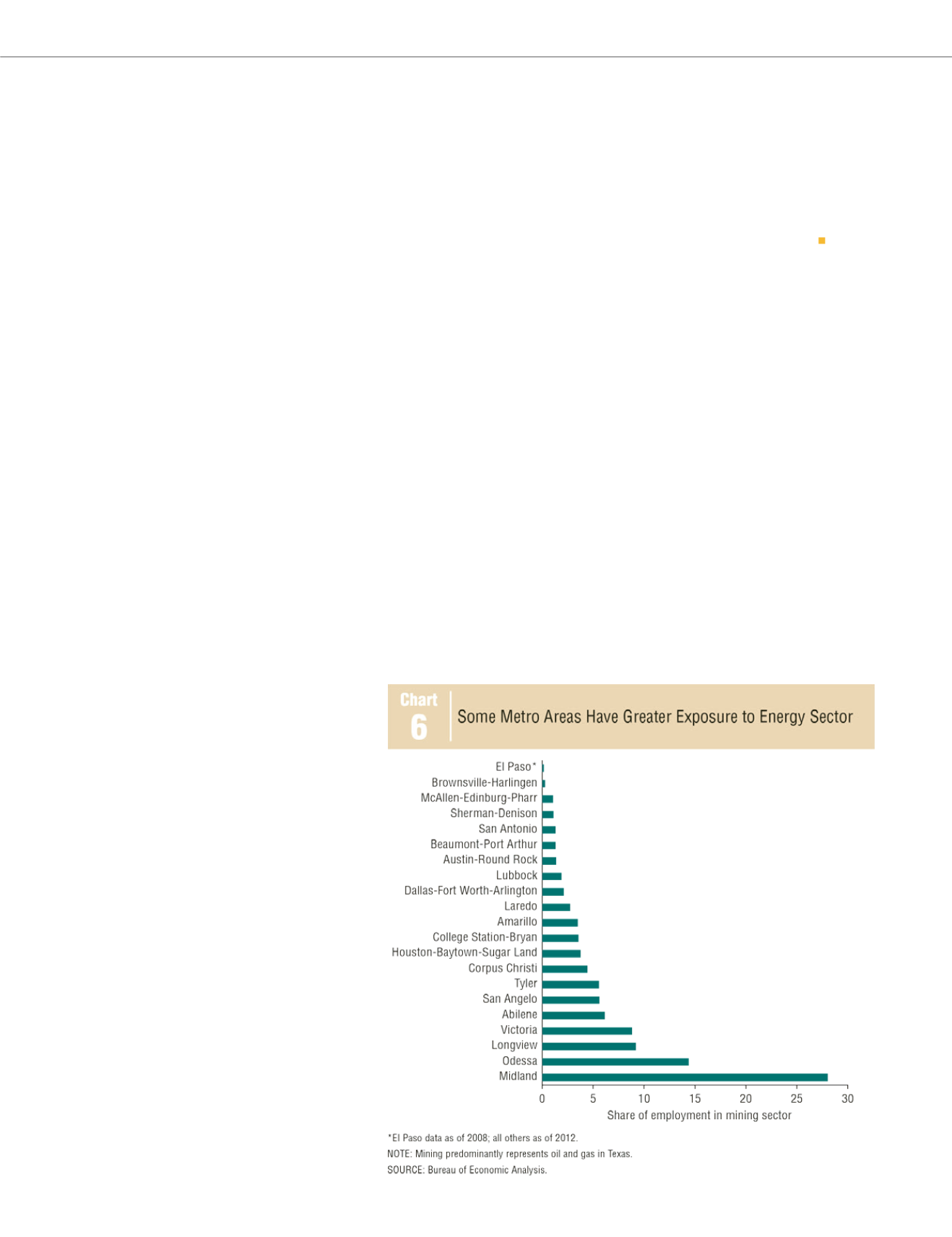

Finally, metropolitan areas also will be

impacted to different degrees because some

rely on energy jobs to a greater extent than

others

(Chart 6)

. Places such as Midland,

in the Permian Basin, and other areas more

reliant on oil and gas employment are

more likely to feel the brunt of the negative

impacts. Houston, where almost 25 percent

of all jobs in Texas are located, is the most

exposed among major metropolitan areas,

with almost 3.8 percent of area jobs related

to mining. On the other hand, cities such as

El Paso and Austin have comparatively less

exposure and may even benefit from falling

oil prices.

Negative Effects for 2015

The oil and gas sector inTexas has grown in

relative importance in recent years, but by

most metrics the state is not as dependent

on the sector as it was in the early 1980s.

Despite this, research suggests that lower

oil prices will negatively affect the Texas

economy, with one model predicting that

about 140,000 jobs could be lost statewide.

Although this is a large number, it is

not expected to bring net job growth to

a standstill, given recent employment

expansion inother sectors of the economy.

Most susceptible to the downturn are

areas of the state with high oil production

and with numerous oil-related jobs.

However, the overall impact will also

crucially depend on just how long oil

prices remain depressed, a difficult thing

to predict given the uncertain and often

volatile nature of oil prices.

Plante is a senior research economist in

the Research Department at the Federal

Reserve Bank of Dallas.

This article first appeared in the First Quarter

2015 issue of Southwest Economy and is

reprinted with permission.

Notes

1

The employment share is the number of jobs related

to oil and gas production divided by total nonfarm

employment, which includes all jobs in the private and

public sectors except those related to agriculture.

2

The share is calculated as the sum of nominal gross domestic

product (GDP) in oil and gas extraction and support activities

for mining divided by total nominal GDP for the state, using

publicly available data from the Bureau of Economic Analysis.

3

Details can be found in “The Shale Gas and

Tight Oil Boom: U.S. States’ Economic Gains and

Vulnerabilities,” by Stephen P.A. Brown and Mine K.

Yücel, Council on Foreign Relations, October 2013.

4

See “North Dakota Discloses Break-Even Prices,”

Oil Daily, Oct. 17, 2014.