12

Texas Association of Builders

July/August 2015

Feature

Interpreting the Number

The 140,000 job-loss forecast estimates

the number of jobs that currently exist

but would disappear because of lower oil

prices. It includes cuts in both oil- and

gas-related and non-oil sectors. The latter

losses can occur, for example, because

employees who lose their jobs in the

oil and gas sector may reduce spending

on other goods and services such as

restaurants, which can lead to reductions

in local service sector employment.

The number should not be viewed as a

forecast of a jobs contraction in Texas

in 2015. Rather, putting the number

into context requires considering the

contributions to employment growth

from non-oil sectors. In recent years, the

state has produced a significant number

of jobs across all sectors. For example, the

state added 373,000 jobs in 2012; 300,000

in 2013; and more than 380,000 in 2014.

While the disappearance of 140,000 jobs is

significant, it pales relative to the number

created in recent years. As a result, if one

takes the model literally, the prediction

suggests that falling oil prices alone will

lower the rate of net job growth but will not

bedetrimental enough tobring employment

expansion to a halt. This is in line with a

recent forecast produced by Dallas Fed

economist Keith Phillips, who anticipates

that Texas employment will grow 1 to 2

percent, compared with 3.4 percent growth

in 2014. This forecast is based on a model

totally unrelated to the one in the Council

on Foreign Relations report, though it tells

roughly the same story.

Varying Impacts in Texas

Negative effects of the price decline will

probably not be evenly spread across

Texas, for at least three reasons. First,

oil production is not evenly distributed

across the state. Second, some areas are

more profitable to drill in than others.

Third, the importance of oil- and gas-

related employment also varies across

metropolitan areas of the state.

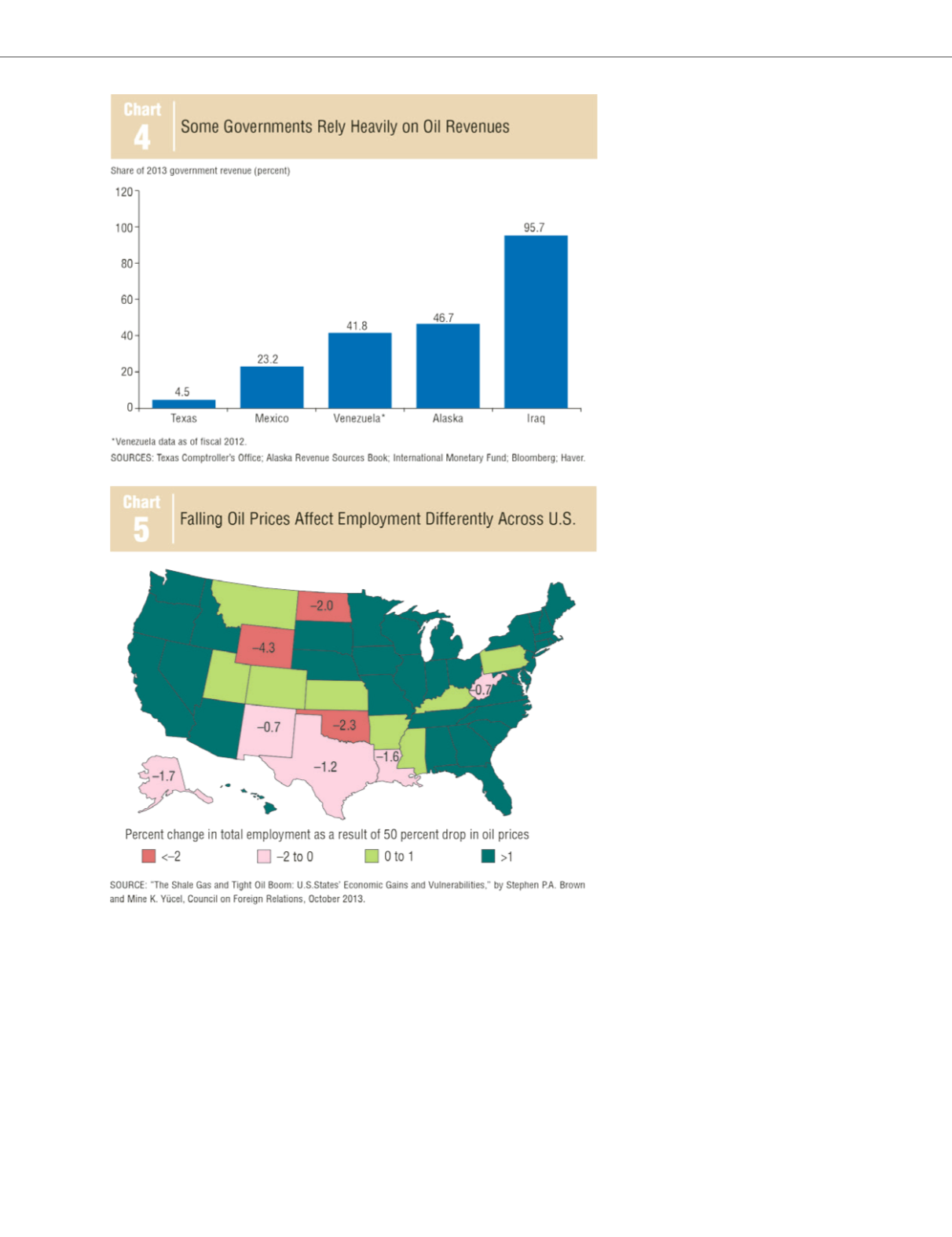

changes affect employment in each

state. The model takes into account a

state’s overall exposure to the oil and

gas sector as of 2012. It also makes other

assumptions, such as how responsive

employment in various sectors is to

changing oil prices.

3

The model predicts that an oil price

decline would negatively affect total

employment in eight states and positively

influence jobs in 42. The percentage

impact on total employment from a

50 percent oil price drop varies across

the states

(Chart 5)

. For Texas, the

model predicts that the number of jobs

eliminated by such a decline would equal

1.2 percent of total nonfarm employment,

which averaged about 11.7 million in

fourth quarter 2014.That translates to

about 140,000 jobs at risk.