14

www.

cbai

.com

+

Community Bankers Association of Illinois

Bank

notes

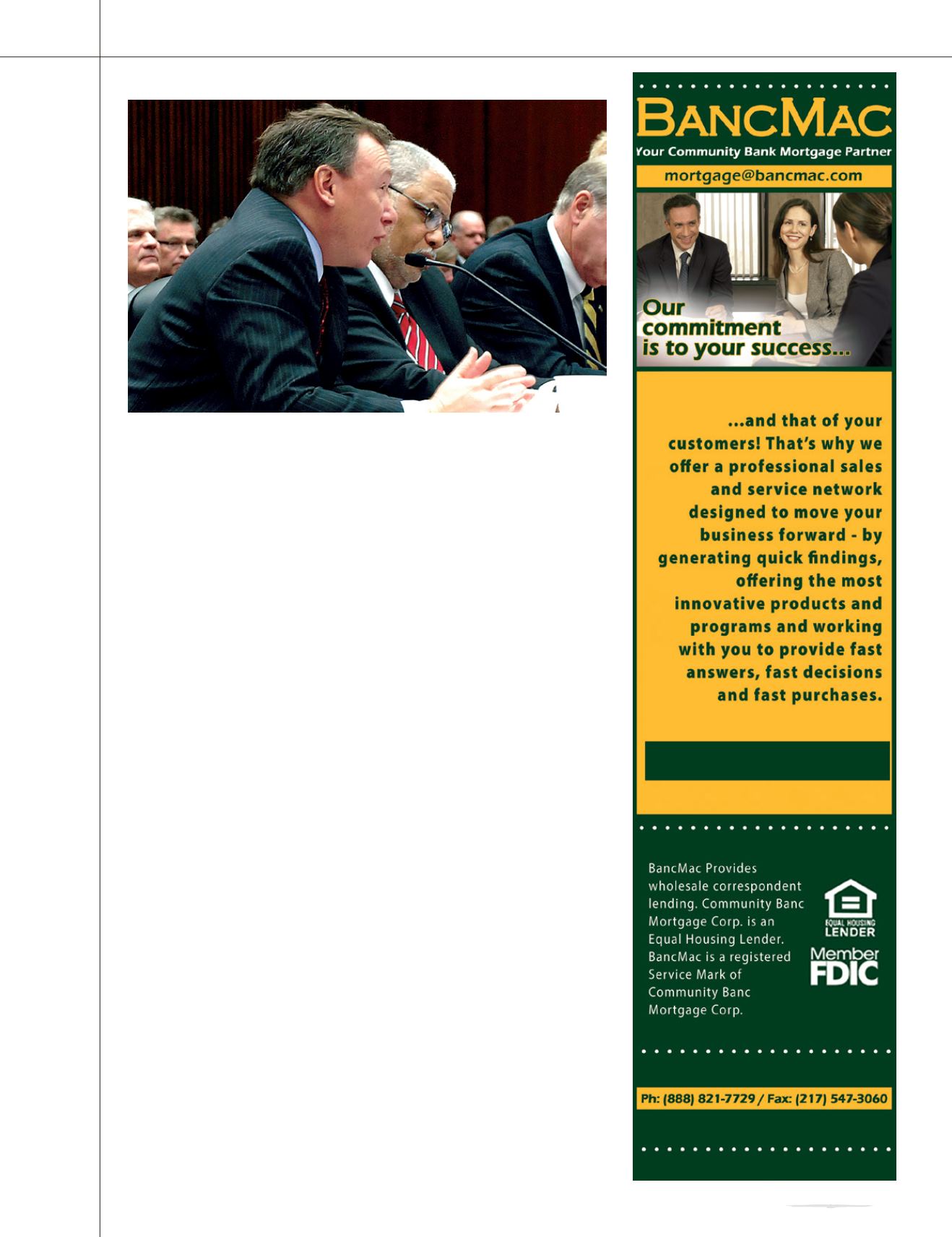

Call on Washington, where CBAI

members meet with their lawmakers

and regulators.

Schroeder also meets regularly with

representatives of the Federal Reserve,

FDIC, OCC, FHFA, CFPB, and

the Federal Home Loan Bank, often

at their Chicago regional offices.

Given the emphasis on federal

rulemaking to implement banking

legislation, Schroeder’s time is

increasingly devoted to researching

and commenting on proposed rules.

CBAI’s goal in rulemaking is to

convince the regulators to construct

new or revised rules which are

appropriate for community banks

including outright exemptions.

In addition, Schroeder coordinates

CBAI’s federal activities with the

ICBA. Karen Thomas, ICBA senior

executive vice president, government

relations & public policy, said, “ICBA

appreciates CBAI’s commitment to the

federal effort. Schroeder’s real-world

community-banking experience is a

valuable resource and complements

ICBA’s efforts to encourage the

Illinois delegation to support and pass

legislation which will help community

banks compete and thrive.”

Schroeder is also responsible for

informing CBAI members about the

Association’s federal activities and

initiatives through E-News articles,

website postings, Action Alerts, and

speaking at various CBAI conferences

and events. These efforts are

intended to keep members informed,

generate support for CBAI’s federal

agenda, and build participation in

grassroots lobbying.

Concluding Comments

Community banks need regulatory

relief via implementation of tiered

regulations based on size and risk

that outright exempts community

banks from some regulations and

lightens the impact of others. Mega

banks generally do not support

exempting community banks from

regulations unless they are exempted

as well. Mega banks oppose being

downsized or functionally restricted

so they can continue to take large

risks for large rewards.

Community banks must maintain

autonomous representation to insure

that their needs and interests aren’t

compromised by the self-interests

of mega banks. Community banks

need to engage in grassroots lobbying

with the guidance and direction of

CBAI and ICBA. Now is the time

for community banks to effect sorely

needed changes!

n

Greg Ohlendorf

(First Community

Bank and Trust,

Beecher) testifies

before the House

Financial Services

Committee.