+

September 2015

11

Community Bankers Association of Illinois

Bank

notes

by community banks, and CBAI

believes that regulations should be

tiered to reflect those differences.

The regulatory burden imposed on

community banks by a one-size-fits-all

approach ignores the disproportionate

burden of banking laws and regulations

on community banks. The steady

increase in regulations over many

decades threatens community banks

and their communities. CBAI urges

Congress and regulators to continue to

expand and refine a tiered regulatory

system based on size and risk profile.

“The One-Voice Myth”

The various financial associations do

work together on issues of mutual

position and interest such as credit

union and FCS taxation. However,

Main Street and Wall Street do not

see eye-to-eye on certain critical issues

such as tiered regulation based on bank

size and downsizing the mega banks to

resolve too-big-to-fail. Despite these

major differences, the associations

representing mega banks often promote

the notion that all banks would be

better off speaking with one voice.

That’s really code for the elimination

of autonomous representation for

community banks. CBAI calls it “The

One-Voice Myth.”

If all banks are the same, then

more than 500 community banks

would not have been closed by the

regulators since 2008.

The enormous size and complexity

of the Wall Street mega banks and

financial firms compelled policymakers

and regulators to bail them out during

the financial crisis. Community bankers

have no illusions that they would

be saved. If their banks fall below

certain minimum regulatory capital

requirements, they will be closed,

period. This grotesque double standard

destroys our free-enterprise system

and threatens the very existence of

community banks if not resolved soon.

If all banks are the same, then

Wall Street would not have a

funding advantage over Main Street

community banks.

Two economists at the International

Monetary Fund (IMF) have determined

that Wall Street enjoys an annual $83

billion too-big-to-fail subsidy. Bloomberg

View’s analysis characterizes this advan-

tage as a competitive imbalance, a market

distortion so egregious that even the often

fractious United States Senate voted 99-0

in support of a resolution to end taxpayer

subsidies for the mega banks.

If all banks are the same, then

regulatory burden would fall equally

on all banks.

Regulatory burden, however, falls

disproportionately on community banks

•

American Bankers Association (ABA)

•

Financial Services Forum

•

American Council of Life Insurers (ACLI)

•

Securities Industry and Financial

Markets Association (SIFMA)

•

Payment Card Industry (PCI)

•

American Insurance Association

•

The Clearing House

•

Investment Company Institute

•

Financial Services Roundtable

•

Financial Institutions Association (FIA)

•

Consumer Bankers Association

•

Institute of International Bankers

•

Center for Capital Markets

•

Equipment Leasing and Finance Association

•

American Financial Services Association

Trade Associations Representing Wall Street Mega Banks:

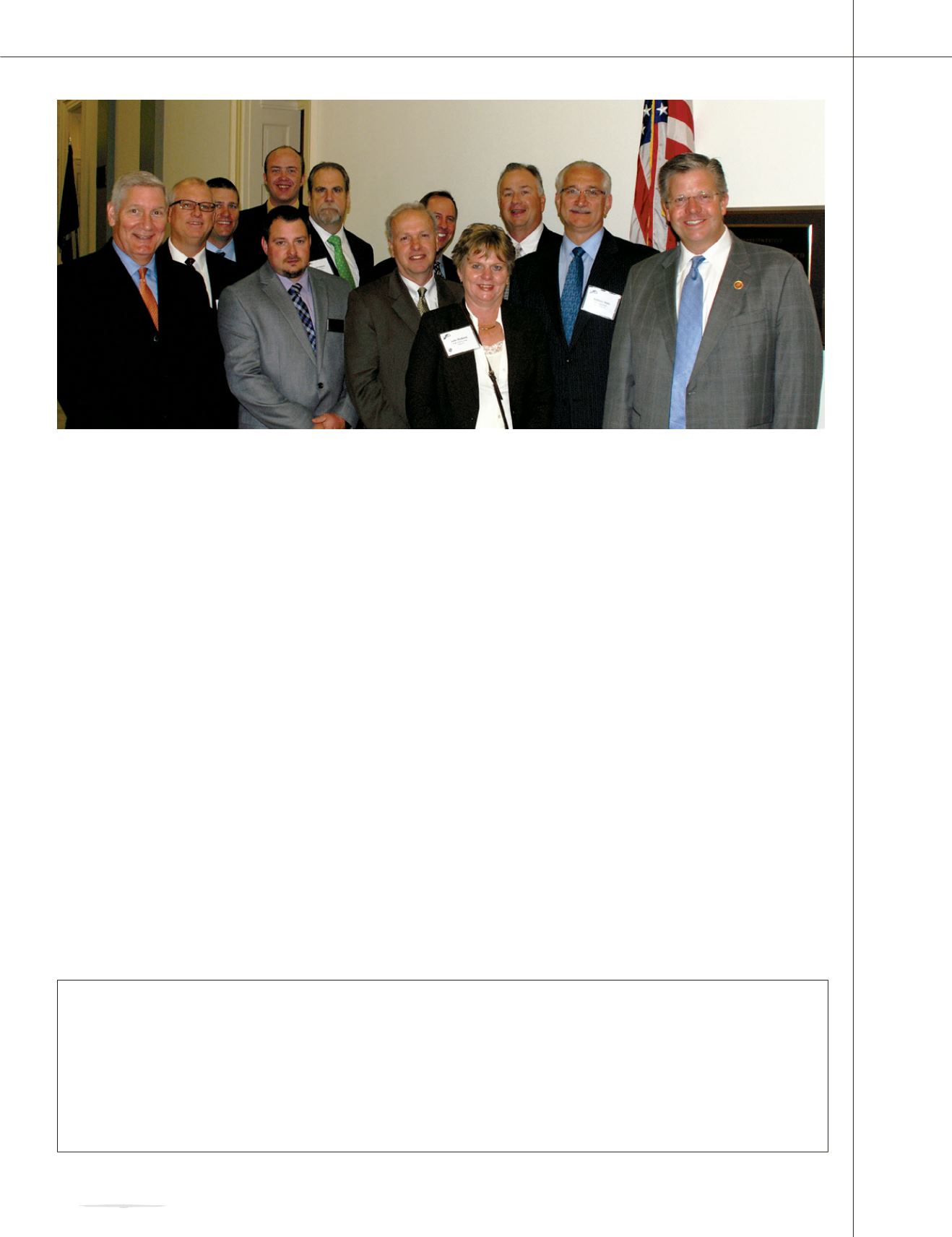

Rick Jameson

(First Community

Bank and Trust,

Beecher); Doug

Parrott (State

Bank of Toulon);

Kraig Lounsberry

(CBAI); Ammon

Simon (Legislative

Counsel –

Congressman

Hultgren); Ryan

Heiser (The Fisher

National Bank);

David Stanton

(PeopleFirst

Bank, Joliet);

Mike Estes (The

Fisher National

Bank); David

Feldhaus (Federal

Home Loan Bank

of Chicago);

Julie Welborn

(The Fisher

National Bank);

Keith Douglass

(Tomkins State

Bank, Avon);

Tony Sisto (STC

Capital Bank,

St. Charles);

Congressman

Randy Hultgren