10

www.

cbai

.com

+

Community Bankers Association of Illinois

Bank

notes

CBAI’s annual Call on Washington

provides a great opportunity for

community bankers to meet with

elected officials while they are in session.

Attendance at fundraisers and town-hall

meetings in the district also helps build

relationships. Personal invitations to

lawmakers to tour the bank and meet

with staff can reinforce positions on

issues as well.

CBAI also maintains two political action

committees, Community BancPAC at

the state level and CBAI FedPAC at

the federal level, to provide financial

support to candidates for elective office.

All community bankers are encouraged

to contribute to these PACs each year

which is essential for an effective

grassroots lobbying program.

Main Street Banks and Wall Street

Firms Have Different Agendas

CBAI’s Federal Policy Priorities (see

sidebar for summary) include the

need to implement a tiered regulatory

structure based on size and complexity

(risk), require credit unions and Farm

Credit System banks to pay taxes

on their profits, and end the double

standard of bailing out troubled mega

banks. Most banks, regardless of size,

agree that credit unions and FCS banks

should pay income taxes. However,

mega banks and community banks have

widely divergent positions on tiered

regulations and resolving too-big-to-fail.

Credit unions have grown to control

a significant share of the banking-

services market. They have abandoned

their founding purpose of serving

individuals of modest means and with

a common bond. Credit unions now

provide the same financial services as

community banks, and their federal

tax-exempt status, granted in exchange

for serving their original purpose, is no

longer justified. CBAI urges Congress

to end this discrimination against

community banks. Credit unions must

pay their fair share.

CBAI opposes the Farm Credit System’s

(FCS) expansionist agenda which has

allowed FCS lenders to become the

virtual equivalent of commercial banks

while retaining the benefits of their

Government Sponsored Enterprise

(GSE) status. The funding and tax

advantages of the FCS discriminate

against community banks. The FCS is

the only GSE that directly competes

with community banks. Fannie Mae,

Freddie Mac, and the Federal Home

Loan Bank System all work cooperatively

with community banks. It’s the epitome

of unfair competition when the public

sector (multi-billion dollar GSE)

competes directly with the private

sector (Main Street community banks).

If the FCS chooses not to follow its

narrow historic mission, then it should

be abolished or subjected to taxation

and rigorous oversight and regulation.

A tragic result of the financial crisis

that exploded in 2008 is that the mega

banks have only grown larger, more

complex and interconnected, and

remain candidates for future bailouts.

Too-big-to-fail banks, not community

banks, caused the mortgage meltdown

and financial crisis, and our nation and

banking profession must be protected

from another massive financial crisis.

These mega banks have demonstrated

that they cannot be effectively managed,

supervised, disciplined, or resolved.

They must be downsized, and no

community bank should ever again be

judged by banking regulators as too-

small-to-matter.

CBAI continues to urge Congress

and banking regulators to reform

the financial system to reduce,

to the greatest extent possible,

the probability and severity of a

another financial crisis. Taxpayer

bailouts of mega banks must never

happen again!

The risks taken by mega banks are

very different from those assumed

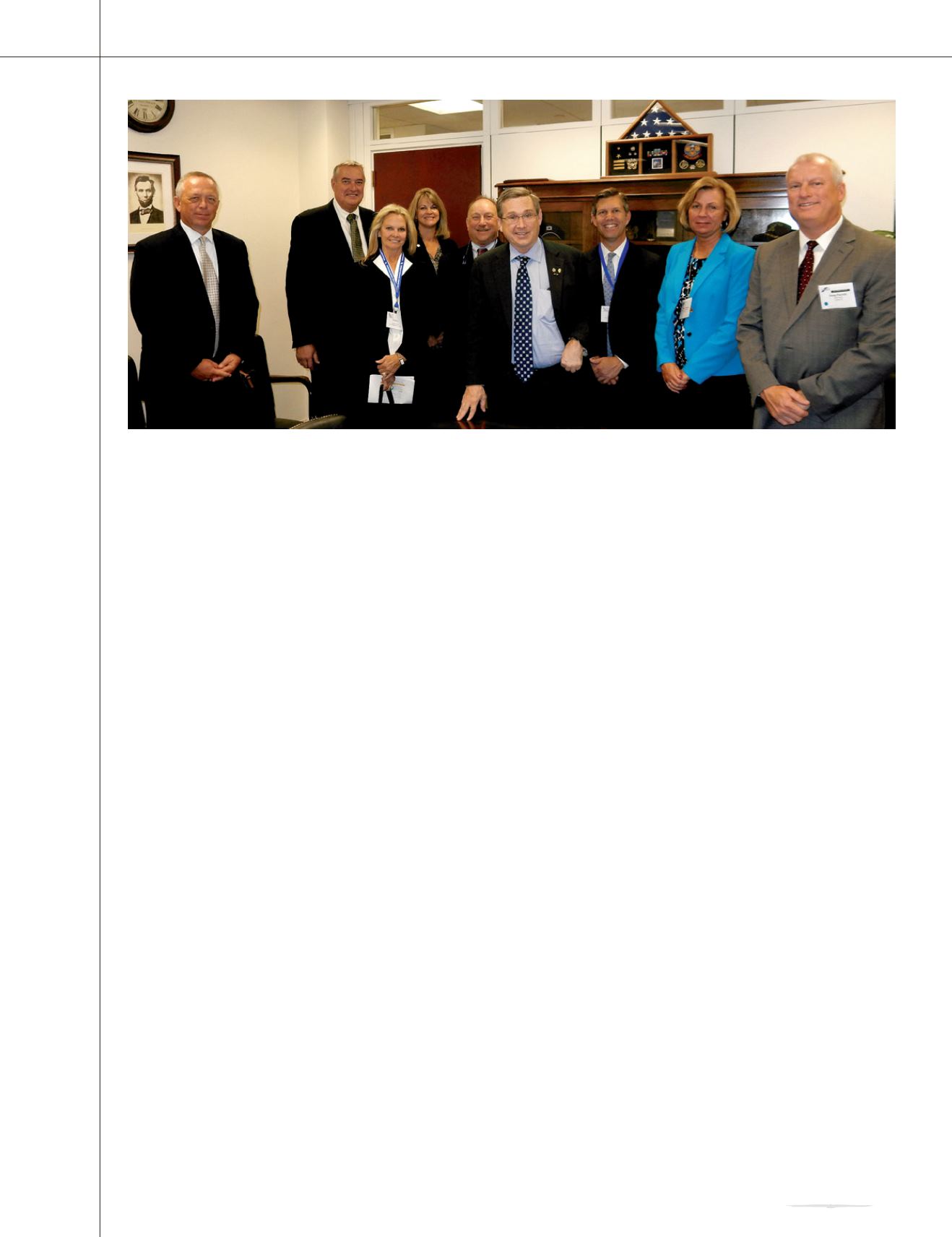

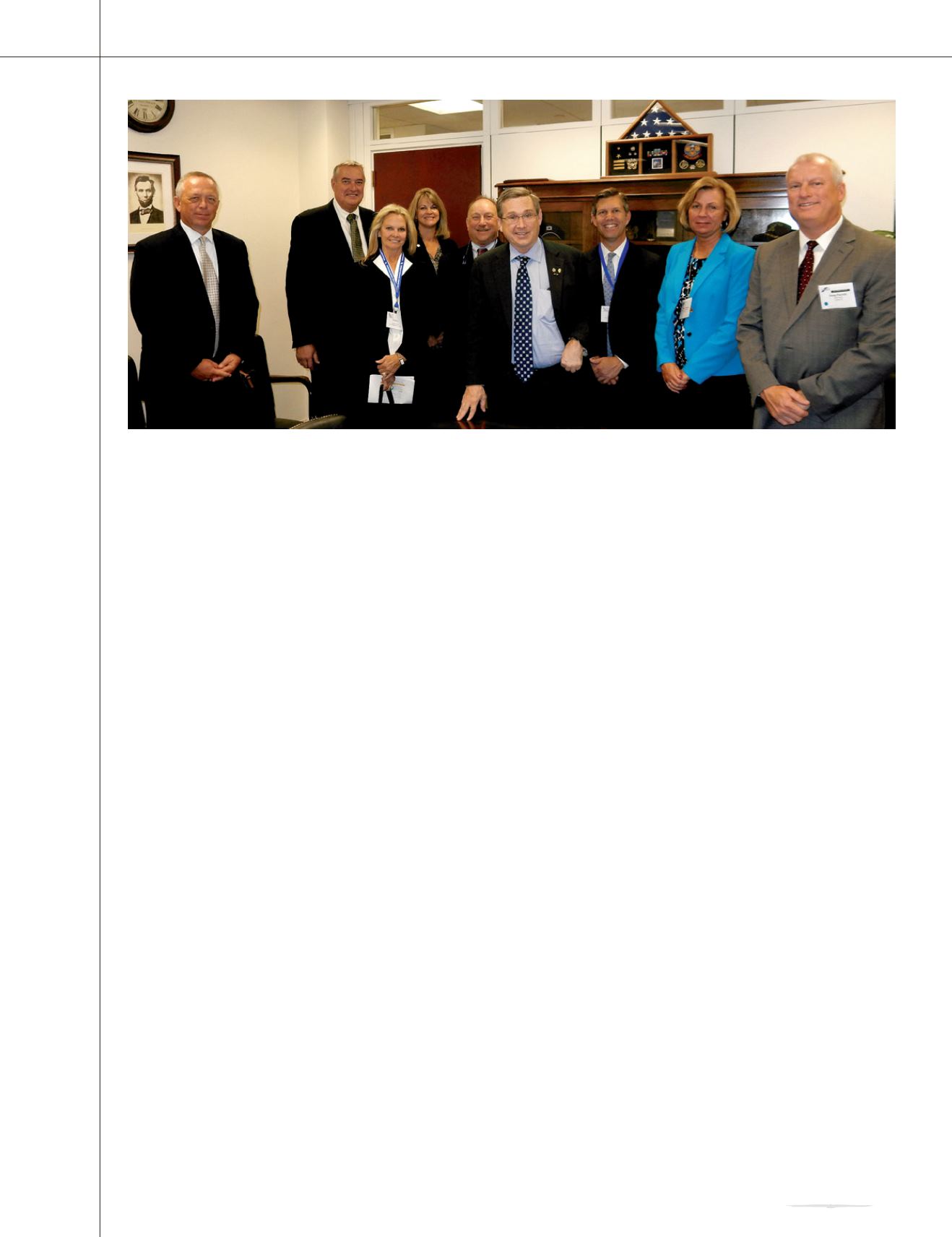

Mike Kelley (CBSC);

Bill Wubben (Apple

River State Bank);

Kathleen Cook

(Village Bank,

St. Libory); Mary

Sulser (Buena Vista

National Bank,

Chester); Tom

Marantz (Bank

of Springfield);

Senator Mark Kirk;

Douglas Dove

(Shelby County

State Bank,

Shelbyville); Dianna

Torman (Prairie

Community Bank,

Marengo); Doug

Parrott (State Bank

of Toulon)