12

www.

cbai

.com

+

Community Bankers Association of Illinois

Bank

notes

whichmust spread the costs of compliance

over a smaller number of employees and

customers. Tragically, the very cause of

many new regulations imposed on Main

Street community banks is the result of

Wall Street greed and customer abuse.

If all banks are the same, then

Wall Street’s directors and senior

management would be prosecuted

alongside community bankers.

The United States Attorney General, in a

disturbing moment of candor, admitted

in Congressional testimony that his

office was reluctant to prosecute and jail

Wall Street bankers for their misdeeds

because of the potential impact on the

financial system and economy.

The AG’s office has a much different

approach to community bankers who

are vigorously prosecuted for their

alleged violations. We are all not all the

same when the American Constitutional

right of equal justice under the law does

not apply to everyone.

If we should all be speaking with

one voice, then the Wall Street

mega banks should have no need for

their own separate representation.

While Illinois community banks have

two associations singularly dedicated to

representing their interests, CBAI and

ICBA, the mega banks have a stunning

15 associations representing them

in Washington, not to mention their

own internal lobbying operations (see

sidebar). As a result, their call for one

voice rings hollow. An estimated 4,000

highly-paid lobbyists now represent

Wall Street on Capitol Hill, and the

head count is growing in an all-out effort

to defeat attempts to downsize the mega

banks and increase their capital and

liquidity requirements.

If we all spoke with one voice,

community banks would not have

won hard-fought FDIC insurance-

premium relief.

The mega-bank lobby opposed the

provision to permanently increase the

FDIC coverage limit to $250,000 and

change the FDIC premium assessment

method that has subsequently saved

community banks billions of dollars.

Given the markedly divergent positions

on such critical issues as too-big-to-fail,

capital and liquidity requirements, and

tiered regulations, one voice is truly a

myth. The fact remains that Wall Street

does not care about the needs and

interests of community banks.

CBAI and ICBA exclusively represent

community banks and are not conflicted.

No time is wasted on complicated

mental gymnastics to spin or finesse

CBAI’s 2015 Federal Policy Priorities (Summary)

The Community Bankers Association of Illinois (CBAI) supports fair competition for financial services, the clear separation of banking and commerce, the dual banking

system, and opposes the concentration of economic and financial resources as evidenced by mega banks deemed too-big-to-fail. Based on these principles, CBAI

has identified the following 2015 Federal Policy Priorities to help community banks operate successfully and better serve their customers and communities.

•

Downsize Too-Big-To-Fail Banks and Financial Firms to Protect Our

Financial System, Economy, and American Taxpayers from Future Bailouts

•

Support Tiered Regulations and Supervision for Community Banks as

Contained in the Independent Community Bankers of America’s Plan for

Prosperity

•

Support Taxation of Credit Unions and Oppose their Expansion of Powers

•

Support Abolishing or Reigning in the Farm Credit System

•

Support Enhanced Cyber, Data and Payment Card Security

•

Support Mortgage Lending and Housing Finance Reform

•

Oppose “Disparate Impact” Fair Lending Causes of Action

•

Support Consumer Financial Protection Bureau Reform

•

Support DeNovo Community Bank Formation

•

Maintain the Federal Home Loan Bank System

•

Oppose Excessive Intervention in Monetary Policy

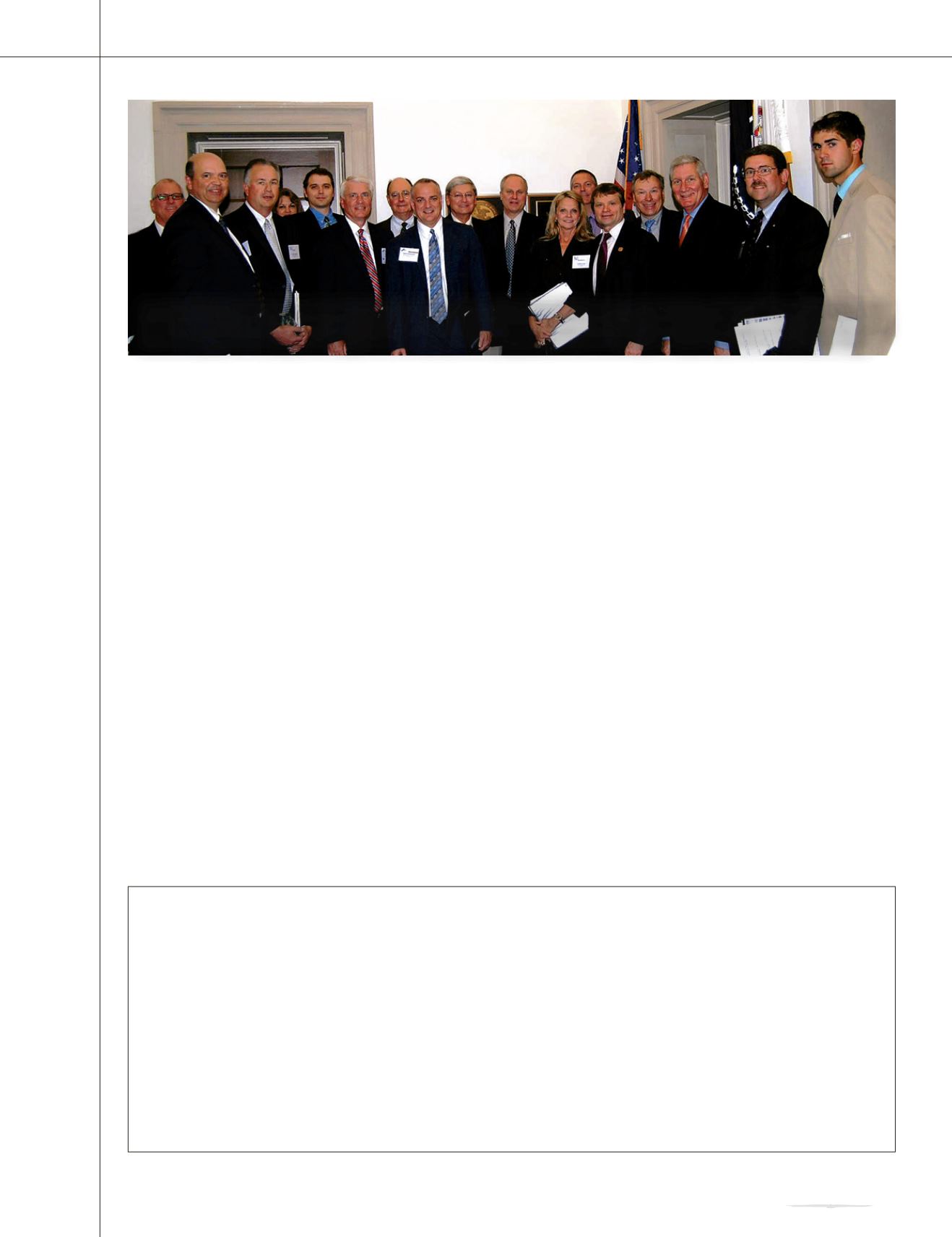

Doug Parrott (State Bank of Toulon); Gerry Johnson (Grand Ridge National Bank); Keith Douglass (Tomkins State Bank, Avon); ); Mary Sulser (Buena Vista National Bank, Chester); Adam Johnson

(Grand Ridge National Bank); Kerry Bell (First Trust and Savings Bank, Watseka); Bob Wingert (CBAI); Mitch Borneman (Heritage Bank of Central Illinois, Trivoli); Jim Ashworth (CNB Bank & Trust,

N.A., Carlinville); Kevin Beckemeyer (Legence Bank, Eldorado); Kathleen Cook (The Village Bank, St. Libory); Martin Rowe (First Eldorado Bankshares); Congressman Mike Quigley; Greg Ohlendorf

(First Community Bank and Trust, Beecher); Rick Jameson (First Community Bank and Trust, Beecher); Mark Field (The Farmers Bank of Liberty); Bobby Field (The Farmers Bank of Liberty)