TexasBuilders.org

TexasBuilders.org

15

Government Relations

up 26%. That means that, statewide, taxes

are rising 2.5 times faster than median

family income. That is the problem that

we are here to address.”

The Select Committee will continue to host

interim hearings around Texas over the

course of the 2016 interim period to review

the tax burden on Texas taxpayers. TAB

staff will attend, monitor, and coordinate

*Source: Texas Senate Select Committee for Property Tax Reform and Relief, 1/27/2016

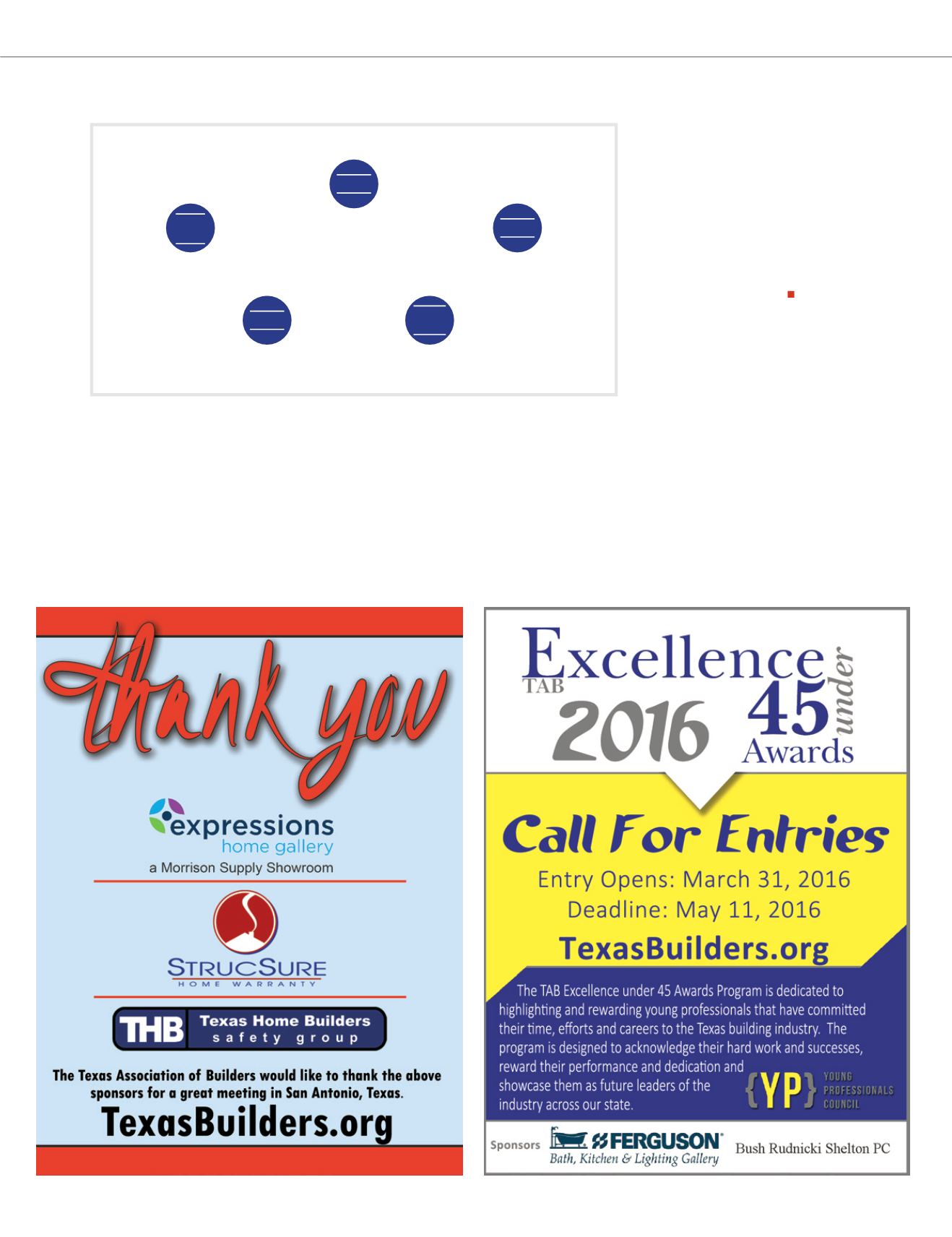

THE PROPERTY TAX CYCLE

JAN 1

st

Late Spring

to Summer

JULY–SEPT

OCT 1

st

–

JAN 1

st

FEB 1

st

JANUARY 1: CentralAppraisal District

sets initial appraised value

Property owners get notices of appraised

Value. Owners may protest theirValue to

theAppraisal Review Board

Any unpaid property taxes become delinquent

and penalties with interest are imposed.

Taxing Units hold public meetings

and adopt tax rates.

Tax Bills sent out by the

TaxAssessor Collector

testimony as needed for these hearings. The

TAB Government Relations Committee has

a designated Tax Task Force that reviews any

changes to the current tax system to ensure

there is no unfair burden on your business,

Texas homeowners, home buyers, and the

home building industry.

.

If you are interested in joining the discussion

on the impact taxes have on our industry

or in your local community, you may join

the TAB Tax Task Force and begin receiving

informational updates. For more information,

visit

http://www.texasbuilders.org/government-regulatory-affairs/get-involved/

grc-task-forces.html.

Sue Pinger serves as voluntary treasurer

for TAB’s Audit and Finance Committees.

Sue also held the CFO title while at

Tilson Home Corporation.